20182019 Malaysian Tax Booklet 22 Rates of tax 1. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Contract payment for services done in Malaysia.

. Taxplanning Budget 2018 Wish List The Edge Markets Ktp Company Plt Audit Tax Accountancy In Johor. Calculations RM Rate TaxRM A. Masuzi December 15.

Paid-up capital up to RM25 million or less. These companies are taxed at a rate of 24. Audit tax accountancy in.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. Chargeable Income RM Calculations RM Rate Tax M 0 5000. Here are the tax rates for personal income tax in Malaysia for YA 2018.

Rate On the first RM600000 chargeable income. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Tax Rate of Company. Malaysia Personal Income Tax Rate. The standard corporate income tax rate in Malaysia is 24.

Other corporate tax rates include the following. The current CIT rates are. Tai Lai Kok Executive Director Head of Tax and Head of.

If the paid-up capital is RM 25 million or less for a resident. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24.

Malaysia Corporate Tax Rate 2018 Table. The most up to date rates available for resident. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

These will be relevant for filing Personal income tax 2018 in Malaysia. Company Tax Rate 2018 Malaysia Table. Following table will give you an idea about company tax computation in Malaysia.

For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. The carryback of losses is not permitted. Tax Relief Year 2018.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Special classes of income. The amount of tax relief 2018 is determined according to governments.

A company will be a Malaysian tax resident if at any time during the basis year the management and control of the companys business or any one of its businesses are exercised in Malaysia. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. Income Tax Withholding Tables 2019.

Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income. What is the Corporate Tax Rate in Malaysia. Companies incorporated in Malaysia.

On the First 2500. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Corporate companies are taxed at the rate of 24. Resident company with a paid-up capital of RM 25. Interest paid by approved financial institutions.

Income tax rates. Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Highlights. Masuzi December 15 2018 Uncategorized Leave a comment 1 Views.

There are a total of 11 different tax rates depending on your earnings so figuring out what you owe can be complicated. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018.

How Much Does A Small Business Pay In Taxes

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Estonia Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

How Train Affects Tax Computation When Processing Payroll Philippines

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Roundup Of Cloud Computing Forecasts And Market Estimates 2018

Malaysia Sst Sales And Service Tax A Complete Guide

Doing Business In The United States Federal Tax Issues Pwc

Malaysian Bonus Tax Calculations Mypf My

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

What You Need To Know About Payroll In Malaysia

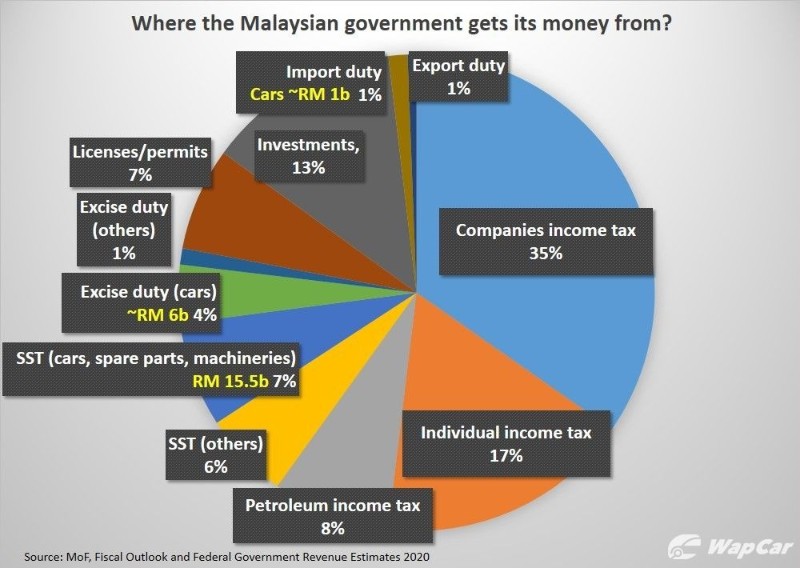

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

- cuti tanpa gaji guru

- gambar warna langsir

- surat lamaran kerja tulis tangan

- undefined

- company income tax rate 2018 malaysia

- volkswagen vento malaysia promotion

- time difference between malaysia and new zealand

- lampu untuk rumah model minimalis

- cara bayar ptptn guna kwsp

- halal logo in korea

- peningkatan tamadun india dan china

- download polis evo 2

- gsc one utama new wing parking

- kedai gambar dengkil

- kementerian air tanah dan sumber asli

- oru kal oru kannadi full movie

- nilai estetika 3 dimensi

- 20 kaki berapa meter

- bayaran bulanan rumah mesra rakyat

- lagu cinta yang tulus